Does that sound crazy or what? Let me just start off saying this it is not my story. This is one of my High School friends who was able to get out of what we are starting to call “normal debt” or student loans.

Caleb’s story started off with him having the desire to go to a Christian University so he didn’t get the benefit of getting cheaper school going to a state school. Lucky he is a pretty smart kid and did all he could to get academic scholarships.

After Caleb meet his lovely wife Danae they soon realized together they had a little bit of debt. To be exact they had $120,963.30 in debt (Caleb was always pretty concise about things). As some of you can relate, starting off a marriage with this amount of debt can be hard so they knew they wanted to make a change.

At this time Caleb’s Dad just so happened to be teaching a class that Dave Ramsey created. So Caleb and his bride Danae decided to check it out. Caleb said from that day on it was hard for them not to want to be out of debt and they would do what it took to do it.

On a side note for those that are married it is much easier to get out of debt and become financial free when you and your spouse are both in board with the idea. Luckily for Caleb they both got the itch to get out of debt together. I recommend doing it as a couple like they did, it will make all the difference in your marriage and your finances.

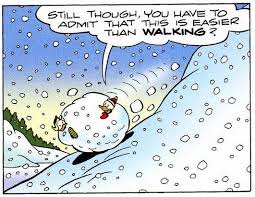

Alright, so Caleb’s story! He talked about some of the strategies that are taught by Dave  Ramsey in his Financial Peace University class. The key concept was the debt snowball. A debt snowball is what it sounds like. You start off with your small debts and once they are paid off then add the extra money towards the bigger debts while always paying at least the minimum payment on all but the smallest debt. The reason I like this strategy is because a lot of people don’t do well with long term goals. This way you are able to pay off the small debts and get the small victories very soon and then make it often. This can help get the momentum going just like a snowball rolling down a hill.

Ramsey in his Financial Peace University class. The key concept was the debt snowball. A debt snowball is what it sounds like. You start off with your small debts and once they are paid off then add the extra money towards the bigger debts while always paying at least the minimum payment on all but the smallest debt. The reason I like this strategy is because a lot of people don’t do well with long term goals. This way you are able to pay off the small debts and get the small victories very soon and then make it often. This can help get the momentum going just like a snowball rolling down a hill.

Caleb did more than just pay the minimum payments (if you do just that you will never get out of debt by the way). They cut their spending drastically (They don’t recommend this to everyone because it can be really hard to keep it up, just like that diet you keep giving up in March). Caleb said they ate out very rarely during this time and didn’t go on any vacations to help put more money towards their debt.

Don’t believe the story still. Here is a graph.

In my opinion this helped shave a few months off on paying their debt off however, the big thing they did to cut cost was on what we think as a fixed cost, our housing. For 6 months out of the 18 months they house sat for someone and saved the money they would have spent on housing. That is a huge save! We spend on average 33% of our expenses in housing and they put all of that towards paying off their debt. If you can do a house hack I recommend it! There are many ways to do things similar. If you know of different ways or want to know leave a comment and we will start a discussion.

Near the end of my conversation with Caleb I asked him what he learned from this experience and it wasn’t how fun debt can be. He said that the diligent are the ones that prosper. He also pointed out that his relationship with his wife became much closer. And that discipline = success.

One last thing that he told me was that the borrower is the slave to the lender. I want you to think about that for a minute. Most of my readers live in a country that was built on freedom. When you take on debt you cut back on your freedom. Think before you go into debt; is it really worth being a slave to have that thing I want?

It was a real pleasure to talk to Caleb and have him give me a brief highlight of his experience of doing what most of us think would be impossible. This is only a small part of his whole story. If you want to know more of the details of how he and his wife did this you can send him a message on Facebook. Click here for the link.

Comment below to share how you got out of debt or getting out of debt. We can also talk more about how Caleb did it.

Thanks for your participation and good luck out there this week!